Read (3 minutes)

Read (3 minutes)

Get on the fast track to more super

Super is money from your employer and your own savings you can use when you retire. As you earn an income it keeps growing a little at a time. But if you want to set yourself up for more choice for your life in retirement, there are two ways to help your super savings grow faster.

Super booster #1: save more

When you earn income, your super gets paid by your employer as a percentage of your salary. That’s something they are legally required to do and that’s why it’s called the superannuation guarantee. But your super savings don’t have to be limited by what you earn. You can make personal payments into super and there are a few different ways to do this.

Learn how to put extra savings into your super

Super booster #2: invest smart

Choosing how to invest your super is another step towards helping your savings grow. When you join a super fund, if you don’t choose how to invest your super, any savings you already have, and any new payments into your account, will be invested in a standardised investment option, known as MySuper. This might be ideal for your life stage and the type of investments you feel comfortable with. But most super funds offer a whole range of investment options and there might be one that is a more appropriate choice for getting the most from your super savings or if you want to play a more active role in your investment decisions.

Get motivated to save

Saving a little extra in your super now can make a big difference to your future income. But this can be hard to get your head around when it’s money you won’t get to spend until you retire. Here are four things to think about when it comes to saving as a way to grow your super:

It’s important to think of super as part of your net worth, just like any other savings account or the $50 note in your hand. Finding out how much super you actually have is a good way to remind yourself that it has real value, even though you usually need to wait until retirement to access your super.

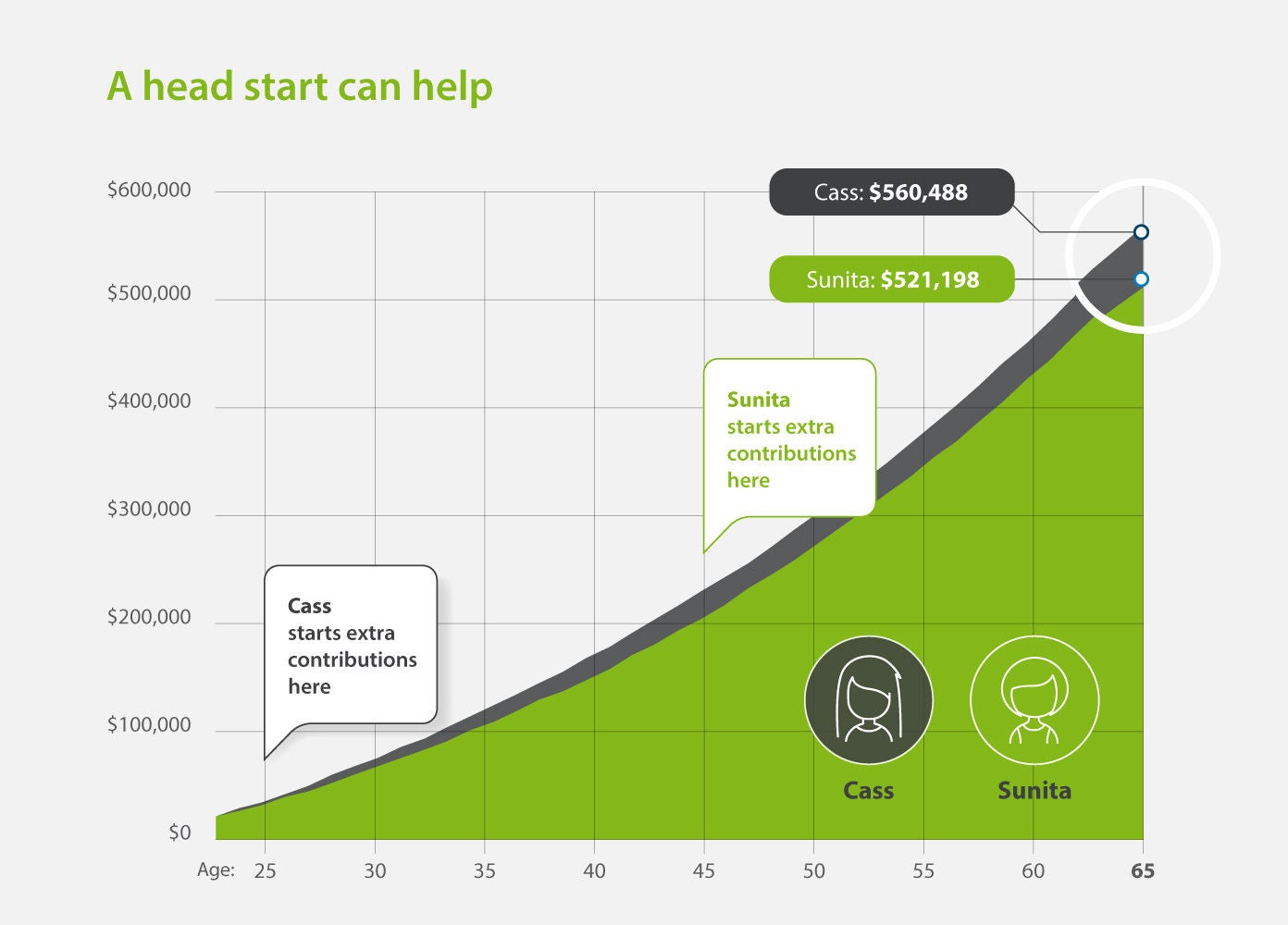

Another way to get motivated to save is to look at the difference your extra savings can make in 30, 20 or even 10 years’ time. See how a head start can help you reach your super goal and find out more about the big changes small savings can make for your super.

Choosing to save more super can be hard if you feel like you’re struggling to make ends meet or you’re saving for something that’s really important, here and now. So you need to think about your other money priorities before choosing to make extra payments into your super.

- Extra super can save on your tax

Making extra payments into super up to a certain amount each year could actually see you pay less in tax. So you get to put more money into retirement savings.

Get educated to invest

When it comes to investing super, knowing how to choose between all the options is a major hurdle to get over. And there are a lot of different things to consider when you’re investing your super, from the time it will be invested to the amount of risk you’re comfortable with or what is suitable for your life stage. We’ll be exploring this all in more detail in another topic - how do you choose where to invest your super? This is where you can get to grips with some investing basics and find out more about what’s involved when you’re choosing super investments.

Find out more about your investment options in super

Snapshot – A head start can help

Saving more in super now makes a lot more sense when you can see the difference it makes.