We use cookies to improve your experience on our website. By continuing you acknowledge cookies are being used.

Find out more about IOOF Employer Super

Go to ASIC's Money Smart website for more information on how to pick the right MySuper fund for you.

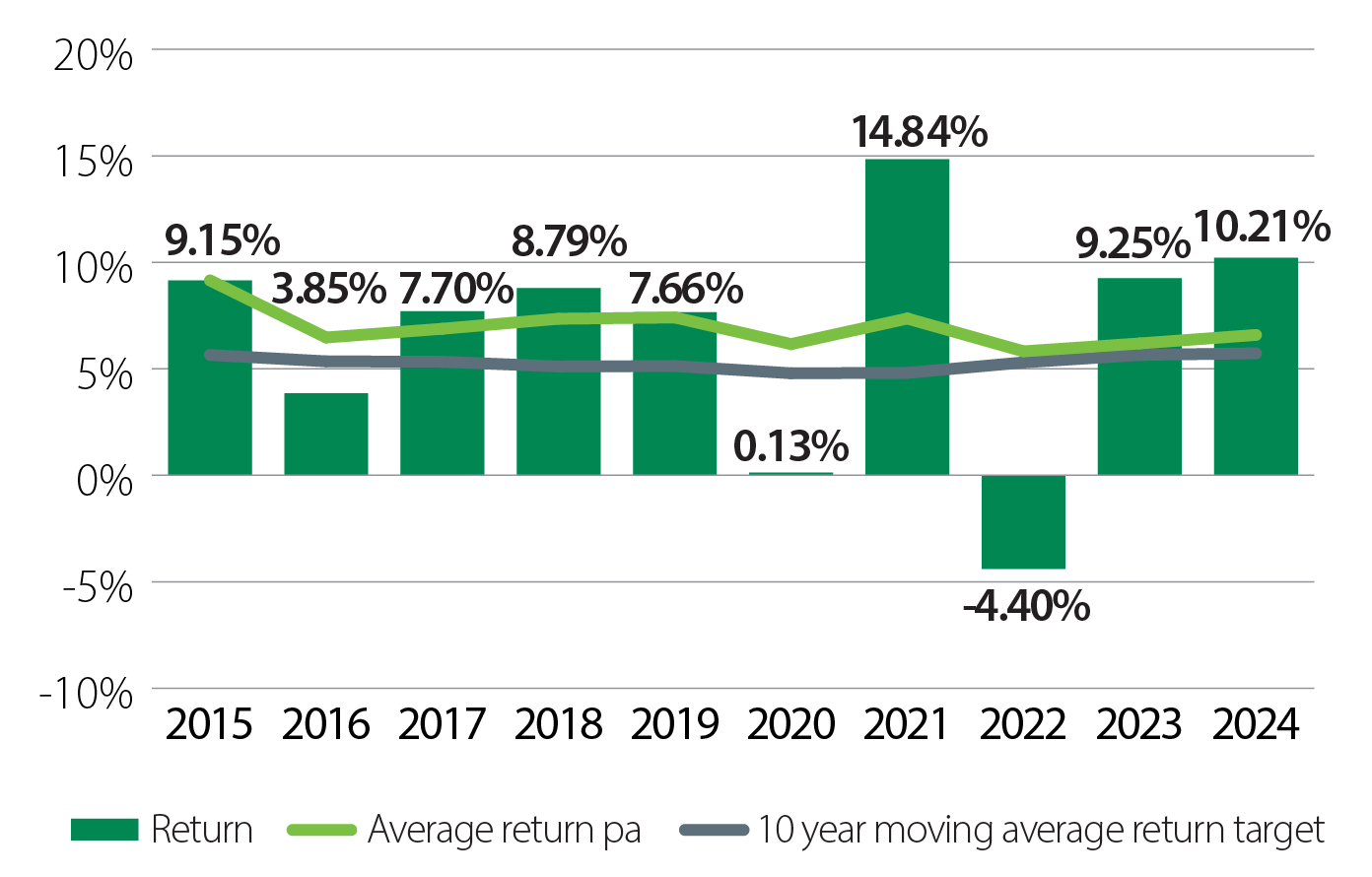

Return

Investment return for IOOF Balanced Growth for the year ending:

30 June 2025: 9.06%

30 June 2024: 10.21%

30 June 2023: 9.25%

30 June 2022: -4.40%

30 June 2021: 14.84%

30 June 2020: 0.13%

30 June 2019: 7.66%

30 June 2018: 8.79%

30 June 2017: 7.70%

30 June 2016: 3.85%

30 June 2015: 9.15%

Return target

CPI plus 3.5% pa after fees and taxes over a rolling 10 year basis.

IOOF aims to achieve or better the return target but cannot guarantee this to occur.

Comparison between return target and return (moving average)

Comparison shown on this dashboard includes the most recent 10 financial years of the IOOF MySuper investment strategy.

MySuper

Level of investment risk

Medium - High

Negative annual returns are expected in 3 to less than 4 out of every 20 years. The higher the expected return target, the more often you would expect a year of negative returns.

Statement of fees and costs

$5281

Fees and costs for a member with a $50,000 balance.

Glossary

The return for IOOF MySuper has been calculated in accordance with APRA reporting requirements. The return is after investment manager fees, IOOF MySuper fees and superannuation taxes. Returns to 30 June 2025 include historical fees different to the fees published on this Dashboard effective 1 June 2025.

The return target for IOOF MySuper has been calculated in accordance with APRA reporting requirements. Note, from 19 August 2024, the IOOF MySuper return target changed from 3.0% pa to 3.5% pa net of all fees and taxes.

Average return targets and average returns are used to show a longer term comparison so that fluctuations in returns earned each year are smoothed out. They are calculated for up to 10 years.

Fees and costs have been calculated in accordance with requirements that apply to MySuper and are detailed below:

| Example – MySuper strategy | Balance of $50,000 | |

|---|---|---|

Administration fees and costs | Administration Fee: (0.25% x $50,000) Account Keeping Fee: $78 Administration costs paid from reserve ($50,000 x 0.02%) | For every $50,000 you have in the superannuation product, you will be charged or have deducted from your investment $135.00 in administration fees and costs, plus $78 regardless of your balance. |

PLUS | 0.55% | And, you will be charged or have deducted from your investment $275.00 in investment fees and costs. |

PLUS | 0.08% | And, you will be charged or have deducted from your investment $40.00 in transaction costs. |

EQUALS | If your balance was $50,000 at the beginning of the year, then for that year you will be charged fees and costs of $528.00 for the superannuation product. | |

For further information, please contact your financial adviser or call us on 1800 913 118.